Are Real Estate Prices Dropping Further?

THE topic of the market right now!! This question alone has divided opinion across the board when it comes to Vancouver real estate. On the one hand, you have people ‘waiting’ for it to drop as low as possible so they can purchase at the most opportune moment. You’ll know these people as they tend to say their tactic out loud when it comes to a real estate discussion, we like the confidence! Then on the other hand, you have those who feel the market has dropped to the bottom already and we’ve seen the price reductions already hit their lowest. So now is the time to buy.

So which side is correct, and who should be doing what now?!

As strange as that may sound, it makes perfect sense. If housing prices are decreasing, that puts pressure on the attached homes market (condos and Townhouse) pricing to drop. Think about it, if you can buy a house that suits your needs, for the same price as a condo, unless you love condo living, you’re going to pick the house over the condo. You’ll typically get more square footage, higher resale value and your own space and land. So if housing prices are reducing significantly, that will have a knock on effect to condos and townhouses.

The second step we look at is ‘time on market’. The simple fact of the matter is, if time on market increases, then pricing decreases. Again it’s quite obvious, if your home is not selling after a long period of time, you reduce the price to increase the chance to be successful. This is just an economic 101, we’re assuming all things are equal and not that you’re using a lack luster Realtor or you are overpriced in the first place for example.

Now obviously this does not happen overnight, but if you were to look at the average time on market during the pricing corrections, you would see an increase in time on market prior to the reduction itself. So yes, there is a lag time between an increased time on market and prices actually reducing.

So where does that leave us to date?

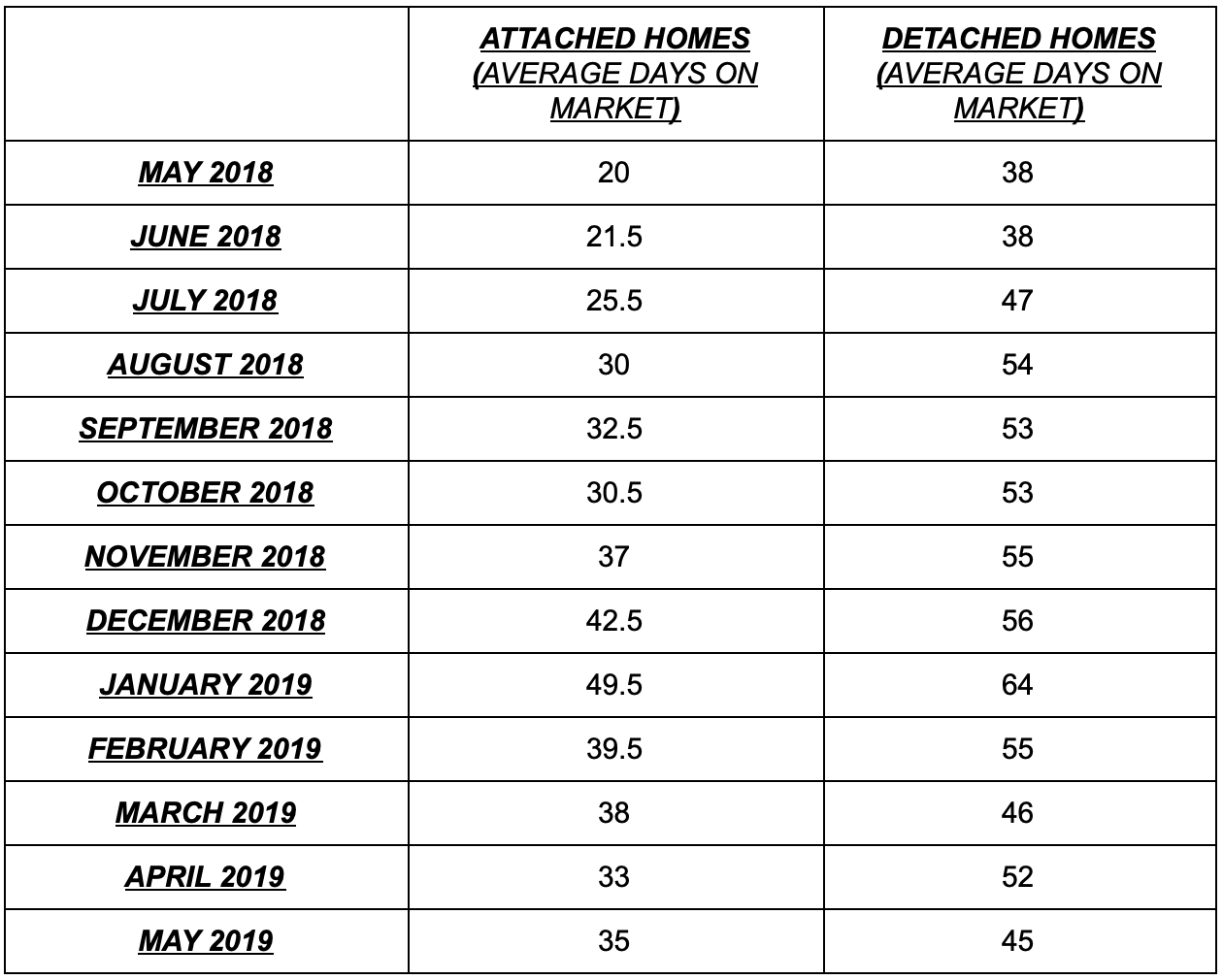

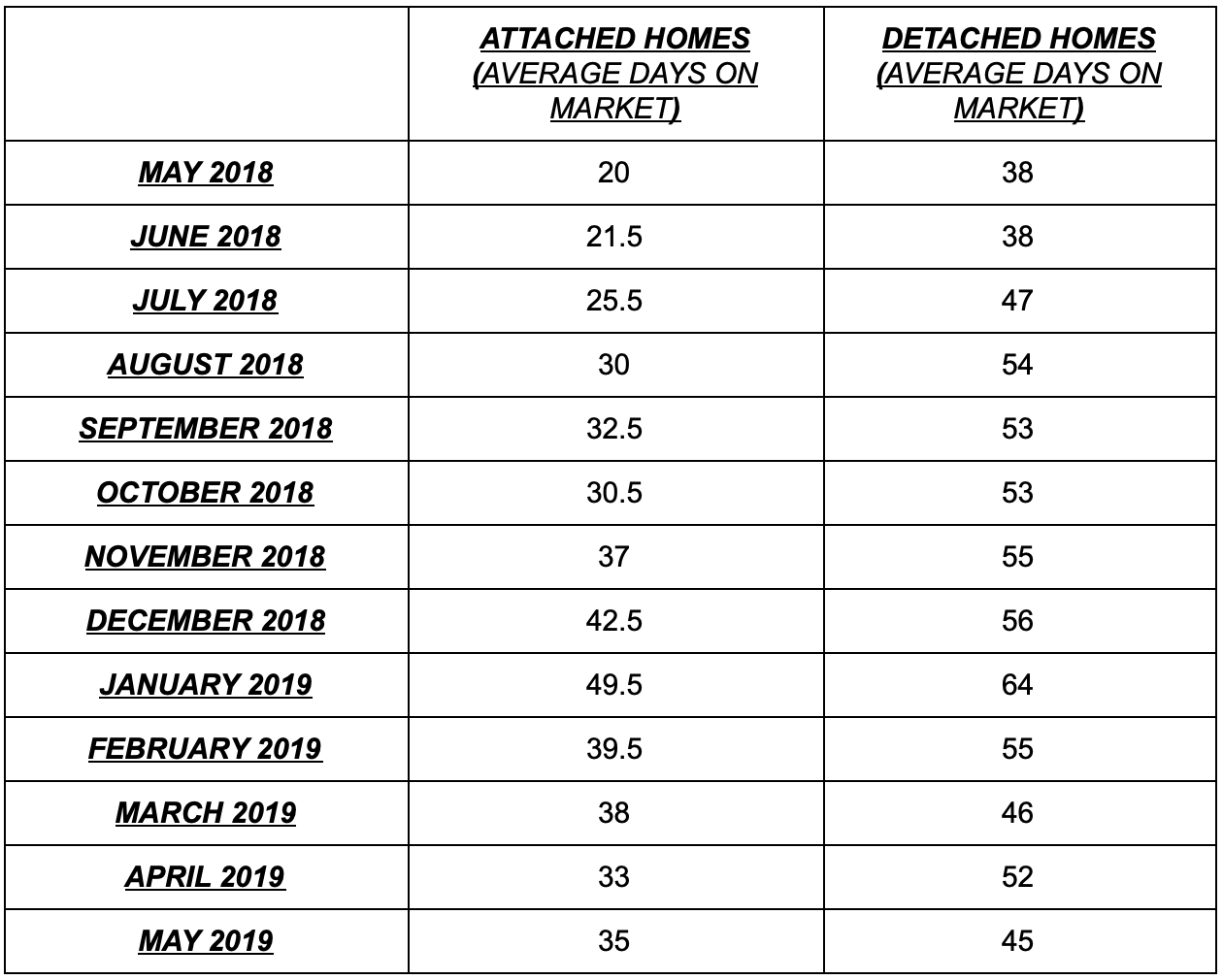

Well take a look at the table below, showing time on market from May 2018 to May 2019:

You can easily see from above, time on market increased to a high point in the New Year (January 2019) and has then started to decrease from there. This is not by coincidence, this is a perfect example of pricing adjustment downwards, reflecting a reduced time on market in the coming months. Now if you look at May 2018 time on market vs. January 2019, that’s quite a substantial difference at over double the time on market, and you’ll see that in the benchmark pricing below. Don’t forget, when pricing adjusts, it has a lag time so you see it in the months to come.

Now there will be people screaming ‘IT’S THE LOWEST AMOUNT OF SALES IN 19 YEARS!!’. However true that is, it’s really irrelevant. The market does not react based on figures from 19 years ago, it can only adjust based on where it is currently at. And from the above table, the market is actually reducing time on market slowly, the opposite of what is needed to see prices drop further.

There have been some outside influences that have played a role in this in our opinion for sure - namely implementation of new taxes and stress test/lending requirements.

Also, don’t forget our first point on detached homes if you are looking for a condo. You will need housing prices to decrease further in order to have your hopeful condo purchase reduce in value.

Now adding salt to the wound here, as prices have decreased and homes have remained on the market, assuming the Vancouver real estate market follows it’s regular trend (which it has done year to date), the amount of listings on the market will start to decrease as we head into summer, meaning less choice for buyers out there. Now let’s not get carried away, in our opinion we feel there will still be a wide variety to choose from, but the fact of the matter is, the more options to choose from, the more pressure there is on sellers. This works in the opposite too, The less to choose from, the less pressure on sellers.

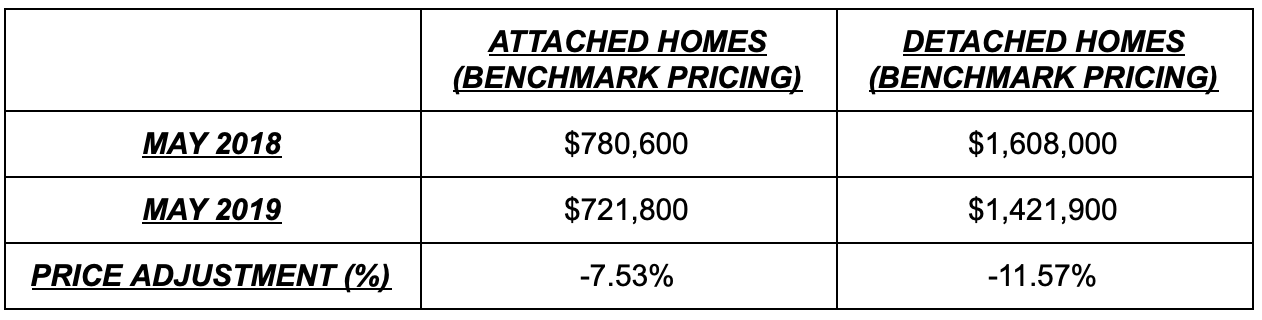

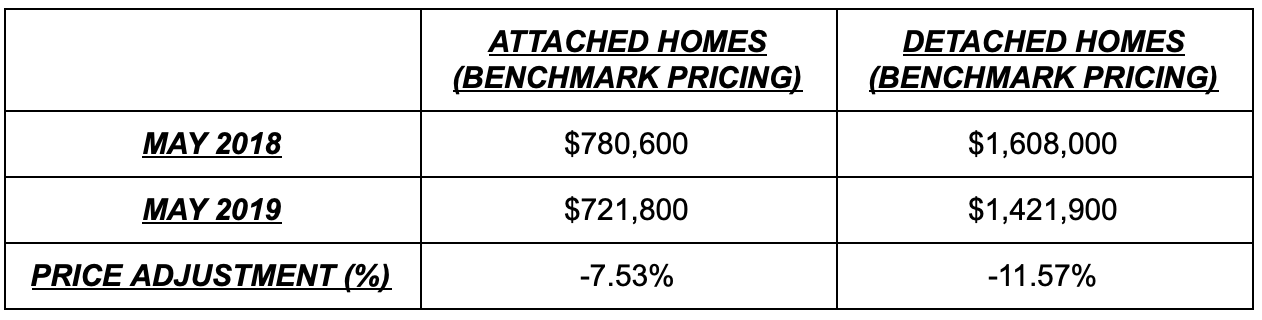

For those of you that operate by benchmark pricing, see the table below to see how the market has adjusted between May 2018 to May 2019 to reflect the adjustment for time on market.

*Statistics are taken from The Greater Vancouver Real Estate Board Statistics release.

These numbers are also only based on the last year (May 2018 to May 2019). Overall this price decrease is larger than the above given percentages.

So in short, if you’re holding out on purchasing because you feel prices will come down further, the signs and statistics are not operating in your favour right now and you run the risk of prices remaining constant, but with less options to pick from in the future. For all you die hard recession fans out there, you can hold out in the hopes the recession will hit and prices will reduce, it depends on your comfort level of gambling, as that’s what that particular tactic is right now.

A longer blog than normal today and we hope you could keep up with us! If you want some further clarification on the above or to ask any further questions, feel free to reach out on the below! You can always watch our video coverage of the blog at the Mcinnes Marketing Youtube channel here. Or listen, during your commute, to our podcast!

Until next week!

THE topic of the market right now!! This question alone has divided opinion across the board when it comes to Vancouver real estate. On the one hand, you have people ‘waiting’ for it to drop as low as possible so they can purchase at the most opportune moment. You’ll know these people as they tend to say their tactic out loud when it comes to a real estate discussion, we like the confidence! Then on the other hand, you have those who feel the market has dropped to the bottom already and we’ve seen the price reductions already hit their lowest. So now is the time to buy.

So which side is correct, and who should be doing what now?!

In order to answer this question we need to understand HOW a price reduction comes about in the first place. In order to do this, we actually start with ……….. Houses a.k.a. Detached homes!

As strange as that may sound, it makes perfect sense. If housing prices are decreasing, that puts pressure on the attached homes market (condos and Townhouse) pricing to drop. Think about it, if you can buy a house that suits your needs, for the same price as a condo, unless you love condo living, you’re going to pick the house over the condo. You’ll typically get more square footage, higher resale value and your own space and land. So if housing prices are reducing significantly, that will have a knock on effect to condos and townhouses.

The second step we look at is ‘time on market’. The simple fact of the matter is, if time on market increases, then pricing decreases. Again it’s quite obvious, if your home is not selling after a long period of time, you reduce the price to increase the chance to be successful. This is just an economic 101, we’re assuming all things are equal and not that you’re using a lack luster Realtor or you are overpriced in the first place for example.

Now obviously this does not happen overnight, but if you were to look at the average time on market during the pricing corrections, you would see an increase in time on market prior to the reduction itself. So yes, there is a lag time between an increased time on market and prices actually reducing.

So where does that leave us to date?

Well take a look at the table below, showing time on market from May 2018 to May 2019:

You can easily see from above, time on market increased to a high point in the New Year (January 2019) and has then started to decrease from there. This is not by coincidence, this is a perfect example of pricing adjustment downwards, reflecting a reduced time on market in the coming months. Now if you look at May 2018 time on market vs. January 2019, that’s quite a substantial difference at over double the time on market, and you’ll see that in the benchmark pricing below. Don’t forget, when pricing adjusts, it has a lag time so you see it in the months to come.

Now there will be people screaming ‘IT’S THE LOWEST AMOUNT OF SALES IN 19 YEARS!!’. However true that is, it’s really irrelevant. The market does not react based on figures from 19 years ago, it can only adjust based on where it is currently at. And from the above table, the market is actually reducing time on market slowly, the opposite of what is needed to see prices drop further.

There have been some outside influences that have played a role in this in our opinion for sure - namely implementation of new taxes and stress test/lending requirements.

Also, don’t forget our first point on detached homes if you are looking for a condo. You will need housing prices to decrease further in order to have your hopeful condo purchase reduce in value.

Now adding salt to the wound here, as prices have decreased and homes have remained on the market, assuming the Vancouver real estate market follows it’s regular trend (which it has done year to date), the amount of listings on the market will start to decrease as we head into summer, meaning less choice for buyers out there. Now let’s not get carried away, in our opinion we feel there will still be a wide variety to choose from, but the fact of the matter is, the more options to choose from, the more pressure there is on sellers. This works in the opposite too, The less to choose from, the less pressure on sellers.

For those of you that operate by benchmark pricing, see the table below to see how the market has adjusted between May 2018 to May 2019 to reflect the adjustment for time on market.

These numbers are also only based on the last year (May 2018 to May 2019). Overall this price decrease is larger than the above given percentages.

So in short, if you’re holding out on purchasing because you feel prices will come down further, the signs and statistics are not operating in your favour right now and you run the risk of prices remaining constant, but with less options to pick from in the future. For all you die hard recession fans out there, you can hold out in the hopes the recession will hit and prices will reduce, it depends on your comfort level of gambling, as that’s what that particular tactic is right now.

A longer blog than normal today and we hope you could keep up with us! If you want some further clarification on the above or to ask any further questions, feel free to reach out on the below! You can always watch our video coverage of the blog at the Mcinnes Marketing Youtube channel here. Or listen, during your commute, to our podcast!

Until next week!

Jay Mcinnes

T: 604.771.4606

jay@mcinnesmarketing.com

Ben Robinson

T: 604.353.8523

ben@mcinnesmarketing.com